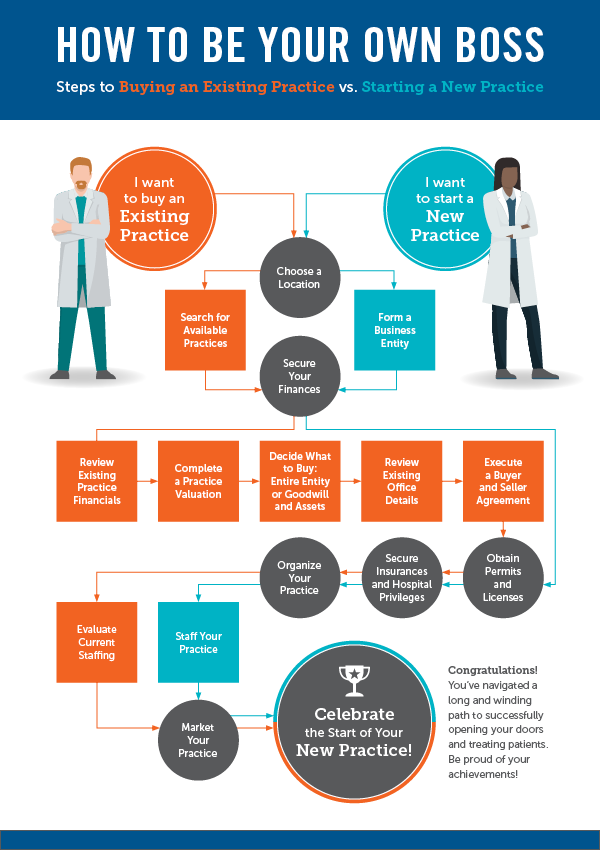

How to Be Your Own Boss

Starting Your Practice: Buying an Existing Practice versus Starting a New Practice

As a resident ready to embark on your career or a practicing physician ready to strike out on your own, you may find that your decision about where to start practice is overwhelming. Whether you’re considering opening a private practice, or buying an existing practice from a retiring physician, both options can seem intimidating and require a thoughtful and comprehensive business plan. You may have limited knowledge of the business world and all the different laws, rules, and regulations that dictate its existence. Every professional pathway is different, and yours may require additional steps unique to you. Knowing where to start can be the most difficult part; this step-by-step guide was created to help you get started on your professional journey. — APMA thanks member Sara Karamloo, DPM, for helping to provide the content for this page.

Choose a Location

Your choice of location will be based on many different factors, including your ability to secure a loan; your financial situation; your support network; the number of doctors who practice the same specialty in that area; your ability to do what you were trained to do without restrictions (check the state scope of practice); and the local cost of living.

Form a Business Entity

If you are opening a new practice, you will need to legally structure your new organization (LLC, PC, S-Corp, C-Corp, etc.) by checking the laws of your state and medical board. Depending on the complexity of these laws, you may want to hire a health-care or business lawyer to help you (e.g., to draft bylaws, draft articles of incorporation, register with state and federal agencies, file designation papers with the IRS). Check with your state component for available resources. It is also recommended that you speak to an accountant regarding the tax implications of the various options you may pursue.

Search for Available Practices

Several different resources can be helpful in finding a practice to purchase. A list of available practices is available on the APMA Career Center as well as in APMA News. Check back frequently as new practices are added regularly. Your state component may also list possible options on its website. Other options include PM News, Podiatry Exchange, and the websites of the individual colleges of podiatric medicine. Word of mouth can be the best way to find a practice, so ask your friends, attendings, co-residents, and pharmaceutical and surgical supply reps if they know of any doctors who are planning to retire. Take the time to physically visit the practice and spend a day or two shadowing the doctor to get a feel for the practice.

Secure Your Finances

Decide what percentage of your own assets you will invest in the practice and what percentage will be purchased on loan. Banks tend to be lenient with doctors coming out of residency who want to buy and/or start a new practice, because they base their approvals on projected income rather than past tax returns of the current practice. As such, they may request that you provide them with a business proposal to show what services you will be adding to the current practice to increase its revenue. (View a sample business plan.) Remember, your document is a proposal; the more appealing your proposal, the more likely you will secure a loan. Contact both local and nationally-recognized banks to see if they offer a specific health-care product that fits your needs. Generally, banks will give you a loan for the practice itself and then get you an approved line of credit that allows you to purchase any other equipment you need, as well as the working capital to get started. When you decide on a specific bank for the loan, the bank may require you to open your business account with this bank, and you will be offered incentives for doing so. These incentives may include credit card services for a reduced fee, payroll services, or 0-percent APR credit cards.

Review Existing Practice Financials

It is crucial to ask to review the financial data of the practice, including past tax returns, the current year’s profit/loss statements, and balance sheets. Understand that in most cases, you will be asked to sign a non-disclosure agreement before any of the outlined information is shared with you. Request to evaluate the practice’s patient flow through its scheduling software, as well as its accounts receivable through the billing software. The accounts receivable will give you an idea of the cash flow for the business. Analyzing the outstanding balances greater than 90 days will help you determine how well the billing department is collecting money. Use this information to help you decide whether to look for another billing company or biller. (Note: Additional information about this step and many of the following can be found on the Closing a Practice web page, and also watch the “What to Know When Purchasing or Selling a Practice” recorded webinar.)

Complete a Practice Valuation

Once you have decided on an office, inquire about any existing practice valuations. Even an old valuation will give you some understanding of what it is you are trying to buy. The gross and net profits, profit/loss statements, and balance sheets of the practice may not always represent the whole picture. A practice valuation will put everything into perspective and allow you to see things with regard to assets and goodwill. This information can be crucial when it comes to tax liabilities. If no valuation has been done, you can ask to have one completed on your own; ask the seller to have one done for you; or ask the seller if he or she is willing to agree on one company, or person, to complete a practice valuation of which you can split the cost while the seller maintains the rights to the final valuation. If a valuation has already been completed by the seller, consider having one done on your own. Having your own valuation can be helpful when it is compared to the seller’s valuation, and it may provide you with some negotiating power. Remember, the seller may have a price in mind that is not within the margins of the practice valuation. If there is no willingness to negotiate, then you are better off looking somewhere else.

Decide What to Buy: Entire Entity or Goodwill and Assets

There are two options to choose from when buying a practice. The first is to buy the entire entity, which means you will buy the IRS designation and have the ability to maintain the contracts that the entity has in place. This option will involve informing all necessary agencies of the change in ownership, but it can save you the headache of having to get on the different insurance plans. On the other hand, it can also make you more vulnerable to any past issues with that entity, at least indirectly, including financial liabilities, debts, and other legal actions. The second option is to just buy the assets and goodwill of the practice. In this case, you will need to structure a new organization (LLC, PC, S-Corp, C-Corp, etc.) that will absorb your purchase. Once you have an idea of your financial situation, decide exactly what you want to buy. You should start by checking your state laws to see what type of structure works best for you. It will be beneficial to speak to a tax specialist about the tax implications for the different choices prior to making a commitment. Depending on your familiarity with this process and the complexity of your state laws, you may want to hire a health-care or business lawyer to help you with this portion of the process and guide you on the different requirements (e.g., developing articles of incorporation, registering with the appropriate local agencies, and filing designation papers with IRS).

Review Existing Office Details

There are a number of small details to think about when buying a practice. Start by making a list of everything that will be included in the purchase price including tangibles such as furniture, electronics, equipment, supplies, and medical records, as well as intangibles like phone numbers, fax numbers, websites, online listings, and fictitious (i.e., “doing business as” or “DBA”) names. Decide what you will do with the medical records. If you are buying a practice with paper charts, check with a professional HIPAA-compliant scanning and shredding company to get an estimate on the cost to scan all the charts. You may want to keep only the charts of active patients and have the seller handle the remaining charts and requests for medical records. Determine if the accounts receivable will be included in the purchase price and decide on an appropriate protocol for patients who want to make a payment after you have taken over the practice.

Execute a Buyer and Seller Agreement

When the purchase price and details have been agreed upon by both parties, consider hiring an attorney familiar with medical practice sales to help draft your contract. If the seller is willing to have the contract drafted, consider hiring an attorney to help you review it and make any necessary changes prior to signing. The contract is the most important part of the entire process and will dictate exactly what will occur as part of the transaction and afterward. Include options for purchasing or leasing the office if the seller owns the building. If not, you will want to ensure that a transfer of the current lease agreement is possible, or you will need to find a new location. Include a non-compete clause to prevent the seller from continuing his or her practice nearby. Decide on the rights to the accounts receivable and the collections process if the prior doctor will be maintaining those accounts. Have the seller stay on for a few months if possible to help with the transition and introduction to patients. Ask him or her to send a letter to all patients regarding the sale of the practice and his or her desire for the patients to continue their care with you. Having the seller available will be very helpful when you are in the process of transferring ownership. If the seller chooses to carry the loan, you may want to consider a personal life insurance plan to cover the purchase price and protect your heirs from that debt, in case of a tragedy occurring prior to the practice being fully paid off. Include the seller’s responsibility to abide by all state and federal laws with regard to his or her retirement. Understand that no contract is perfect, and as long as the conditions for purchase are not outrageous, you may have to give in a little bit to make the transaction happen. Having a contract fall through just 24 hours prior to closing is not unheard of.

Obtain Permits and Licenses

If you don’t have them yet, you will need a state license and NPI number. After the business entity has been established and a Taxpayer Identification Number (TIN) has been provided, apply for a business NPI number. Apply for a DEA license if you wish to prescribe medications, and check with your state for local opioid laws and regulations. Check with your state radiation control agency to see if your state requires that you have a specific radiology or fluoroscopy permit to operate an X-ray or fluoroscopy machine. If you purchase an X-ray or fluoroscopy unit, make sure to register your unit and inform your state of any transfer of ownership.

Once your office location has been determined, check with your state board for possible fictitious name permits. You will also need to check with your city and state for a business license. Depending on your practice, you may want to obtain a seller’s permit for any OTC products you might offer. If you decide to participate as a DME supplier for Medicare, be sure to apply for a license and follow the guidelines to make you compliant. Apply for individual and corporate malpractice insurance, in addition to insurance that covers your physical business in case of a fire, theft, etc. You may also want to consider disability and life insurance policies to cover your business in case of a tragedy. Be aware that a physical location, phone, and fax number for the business will be needed to obtain these permits and licenses.

Secure Insurances and Hospital Privileges

As soon as your state license has been granted, apply for hospital privileges in order to be able to apply for insurances and Medicare/Medicaid. You may want to see if there is a credentialing specialist who can help you complete these applications, or if you have hired employees already, they may be able to help with these processes. The sooner you get insurance panel approvals, the faster you can see patients and begin receiving income!

Organize Your Practice

While you are applying for insurance panels and hospital privileges, you will want to start laying out your new office. It is best to write down everything you can think of for running a practice (e.g., electronics, EHR vendor, equipment, supplies, office furniture, etc.) and then look online for the best deals. When it comes to buying medical equipment, supplies, and even some furniture, you may be able to get a larger discount if you buy everything from one or two suppliers. Remember, the beauty of owning your own practice is that you decide how it is run, so be creative and take time to enjoy this part of the process. (Note: Check out the APMA Buyers’ Guide and member affinity programs for possible deals on these items.).

Staffing

Decide on the number of people needed to help run your practice initially. Keep in mind if you are starting a new practice without an existing patient base, it may be necessary to hire only one or two people, or hire on a part-time basis, because your income is likely to be low. As you get busier, you can always hire additional staff. Check out the option of a virtual assistant. Remember that there are important rules and regulations to follow when hiring, most of which can be found on the Department of Labor website, or you can check your state’s specific labor codes. Make sure you research different payroll vendors. Some will provide human resource services for you to ensure you comply with all federal and state laws. Consider creating an employee handbook to outline the different questions your employees may have including dress code, vacation policy, sick leave, etc.

Market Your Practice

Having an online presence, like a professionally designed website with search engine optimization and a professional profile on select social media platforms, can help attract patients. You may want to get professional photos taken of you, your staff, and your office for this purpose. Order professionally designed business cards to carry with you in case you run into a potential referral source. Have referral pads made to give to other local practitioners in your area when introducing yourself. It may be wise to set up an open house at your practice one evening and invite local practitioners to see your office and learn about what you do and the services that you provide. Visit local gyms, nail salons, and running shoe stores and offer free on-site consultation sessions for their patrons. This kind of face-to-face interaction is a great way to introduce yourself to the community and attract new patients.

Celebrate the Start of Your New Practice

Congratulations! You’ve navigated a long and winding path to successfully opening your doors, treating patients, and demonstrating your level of training, knowledge, and expertise. Be proud of your achievements!

Additional Resources:

- "Starting a Cold Practice: Make it a Reality!"

Angela Savage-Davis, DPM, Your APMA May 2015 - Compliance materials

- Checklist for opening a new practice

- Sample business plan (provided by Luke Kovatch, DPM)

- Additional early career resources